Why doesn't your credit score come from the government?

A public credit agency is an idea whose time has come

It's fair to say that most Americans live in quiet fear of their credit score. That little number often decides whether you can buy a home, purchase a car, or even get a job. Landlords, banks, utilities, hospitals, and employers can all see your credit score, or at least the credit report and history from which your score is derived.

Making this rather Big-Brother-ish dynamic even worse, Americans' credit histories are often capricious, irrational, and error-ridden. Thanks to the massive breach of Equifax back in 2017, we know the for-profit companies that run the system — the "Big Three" of Equifax, Transunion, and Experian — can't even manage our data securely. And the credit scores these companies generate tend to reinforce and perpetuate existing disparities of wealth and income, particularly along racial lines.

To fix this mess, the left-leaning think tank Demos recently offered a bold, but seemingly obvious, proposition: Just scrap the private credit scoring system, and replace it with a government agency, accountable to the public.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

There have been previous efforts to at least reform the status quo, like 1970's Fair Credit Reporting Act, and parts of the 2010 Dodd Frank Act. Rep. Maxine Waters (D-Calif.) has a bill that would impose much more drastic reforms and regulations on the Big Three. But even Waters herself wonders "whether the system is so beyond repair that we need to completely rebuild the entire consumer credit reporting sector to truly put consumers first."

"We were working off that idea," Amy Traub, Demos' associate director of policy and research, and the author of the proposal, told The Week. "Why do we need to have this be a private, for profit-function? To be gathering people's personal data and reselling it, and not providing as much a benefit to either consumers or lenders as a public system could?"

Crucially, the Big Three's actual customers are not you and me and the other Americans whose lives are stamped by credit scores. Rather, their customers are the banks and lenders and credit card companies and other businesses that pay for credit reports and scores. Legally, everyone is allowed to see their credit report for free once a year, but to see it more often you have to pay. The Big Three also offer credit monitoring and ID theft prevention products to consumers. But for the most part, everyday Americans are simply not the customers to who these companies are accountable — rather, they're the product the Big Three offer.

Most of the system's problems arguably flow from this simple fact.

For one thing, research suggests that screw ups and material errors in credit reports are relatively common, affecting as many as 20 million Americans. To dispute those errors, people have to go through an automated system that puts the burden of proving the mistake on the individuals themselves. "There's very little investment on the part of the credit reporting companies in trying to provide a system for investigating and correcting errors," Traub explained.

Transparency is also a big problem. Few people understand the standards and algorithms by which their credit history is assessed and their score derived. What we do know of the process doesn't make much sense. Unpaid medical bills, which hit almost one in five consumers, can drag down your credit history — even though medical debts hit randomly, and people rarely have a choice about taking them on, so they're especially poor predictors of how someone will pay off other financial obligations. Another thing that isn't accounted for is predatory lending: How people handle brazenly exploitative terms, like those of payday lenders or the fraudulent mortgages that millions of families were roped into during the 2000s housing bubble, is not a good metric for how they'll handle debts offered on fair terms.

Meanwhile, for anyone who rents an apartment, making all their rent payments on time will not lift their score at all. Nor will making their utility payments. Indeed, having the resources to take on debt in the first place requires a certain amount of class privilege; as a result, roughly 26 million Americans have no credit history at all. Everyday consumers certainly didn't cause the Great Recession, but the impact on jobs and income and financial stability nonetheless increased the portion of Americans with poor credit by 10 percentage points.

Lurking behind much of this is also the question of race. "Wealth is really passed down across generations," Traub pointed out. "Something that happened 40 years ago, before somebody who's applying for a home mortgage today might have been born, still affects them." For African Americans in particular, the long history of slavery, segregation, redlining, and discrimination has massively impacted their ability to build up wealth. There are plenty of poor white people too, but in the aggregate, the black-white wealth ownership gap is enormous. Black Americans, as a group, are far more vulnerable to poverty and to unemployment. As a result, they have more difficulties paying off credit obligations compared to white people, and they're more likely to be targeted by predatory lenders. That reduces their credit scores, which means they get less access to credit, or their interest payments are higher when they do. And all that makes it all the more likely their poor credit history will continue.

Multiple studies in the last decade or two have found significant racial gaps in credit scores. To take one example, a 2017 survey by the Urban Institute looked at 60 U.S. cities, and found an overall credit score gap of 80 points between majority white and majority nonwhite areas. That alone is enough to cost families on the low end an extra $100 a month on their mortgage payments. In 50 of those cities, the median credit score was considered "poor" for the majority of nonwhite areas. In only four cities was this true for the median scores of most of the white areas.

Rather than offering black Americans a way to level the playing field, credit histories and reports usually serve to reinforce and perpetuate existing injustices. "Whenever I raise this, there's someone out there who says, 'Wait a minute, are you saying credit scores are racist?'" Traub mused. "And I am saying credit scores are racist! Because past discrimination is baked into credit scores."

Finally, to add insult to injury, there's been a kind of "mission creep" in what credit scores are used for. These days, nearly two thirds of employers reportedly use credit histories when assessing applicants (though they can't see the actual score), even though there's effectively no evidence those reports are a predictor of an employee's quality or character.

How, then, would a public credit scoring agency address all this?

Traub's proposal envisions a new public agency housed at the Consumer Financial Protection Bureau (CFPB). It would transition in over seven years as it built up its data. Any institution or firm that currently provides credit information to the Big Three would be required to supply that data to the public agency as well. The public agency would also pull in some data from the Big Three themselves, like mortgage payments that date back beyond seven years. At the end of that period, lenders would be forbidden from getting credit scores from anyone but the public agency. Employers would no longer be allowed to look at credit histories either. For all intents and purposes, the market for the Big Three would be wiped out.

This public agency would also seek to develop credit histories and scores in a more just and humane way. Medical debt would be ruled out as a factor, as would predatory lending. The agency's processes and algorithms would seek to account for the impact of past discrimination, and avoid baking it into people's credit histories. It would provide a way for consumers to opt into having things like their rental and utility payments included in their history and scoring. (This can be a complicated question, because people also often don't pay rent because of perfectly legitimate disputes with landlords.) The agency's inner workings would be more transparent, and its system for resolving disputes more user-friendly.

But most fundamentally, the agency would be public and democratically accountable. How exactly it builds its algorithms, how it accounts for past injustices and all the rest, would be a process that everyone — from think tanks to community groups to academics and more — could comment on in the same manner as other rulemakings for other government agencies. All the decisions of this public credit agency would ultimately be answerable to Congressional oversight, and to the policymakers everyday Americans elect to represent us. "A public credit registry would put consumers at the center," Traub concluded. "The goal would not be, let's monetize this data as much as possible. The goal would be, how do we enable consumers to build credit that's appropriate for them, so lenders can use this information to make rational decisions about who to lend to and how much?"

Lastly, Demos' proposal also includes wrap-around reforms to help out everyday Americans with their credit in other ways: ban predatory lending with interest rate caps, reform debt collection practices, reform bankruptcy law, prohibit forced arbitration, defend the CFPB, improve public services and jobs, and more.

Obviously, turning the provision of credit histories and scores over to a public agency is a bold proposal. Modern America is generally not in the habit of solving problems with public options or government provision when the private sector is also available. Yet our credit histories show how the perversities of the private sector can sometimes be worse than those of the public sector, impacting the lives of all Americans — especially the most vulnerable — in sweeping ways.

In an election cycle where an ambitious left-wing populist like Elizabeth Warren or Bernie Sanders could take the Democratic nomination, this may be an idea whose time has come.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeff Spross was the economics and business correspondent at TheWeek.com. He was previously a reporter at ThinkProgress.

-

Today's political cartoons - April 14, 2024

Today's political cartoons - April 14, 2024Cartoons Sunday's cartoons - Trump Derangement Syndrome, social media dangers, and more

By The Week US Published

-

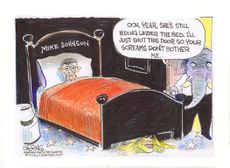

5 rambunctious cartoons about the House speakership standoff

5 rambunctious cartoons about the House speakership standoffCartoons Artists take on Mike Johnson's night terrors, the Speaker's chair, and more

By The Week US Published

-

The Week Unwrapped: Ultrarunning, menswear and a meaty row

The Week Unwrapped: Ultrarunning, menswear and a meaty rowPodcast Is the "Hardest Geezer" a high-endurance trendsetter? Will Ted Baker survive? And what's the beef with lab-grown meat?

By The Week Staff Published

-

Arizona court reinstates 1864 abortion ban

Arizona court reinstates 1864 abortion banSpeed Read The law makes all abortions illegal in the state except to save the mother's life

By Rafi Schwartz, The Week US Published

-

Trump, billions richer, is selling Bibles

Trump, billions richer, is selling BiblesSpeed Read The former president is hawking a $60 "God Bless the USA Bible"

By Peter Weber, The Week US Published

-

The debate about Biden's age and mental fitness

The debate about Biden's age and mental fitnessIn Depth Some critics argue Biden is too old to run again. Does the argument have merit?

By Grayson Quay Published

-

How would a second Trump presidency affect Britain?

How would a second Trump presidency affect Britain?Today's Big Question Re-election of Republican frontrunner could threaten UK security, warns former head of secret service

By Harriet Marsden, The Week UK Published

-

'Rwanda plan is less a deterrent and more a bluff'

'Rwanda plan is less a deterrent and more a bluff'Instant Opinion Opinion, comment and editorials of the day

By The Week UK Published

-

Henry Kissinger dies aged 100: a complicated legacy?

Henry Kissinger dies aged 100: a complicated legacy?Talking Point Top US diplomat and Nobel Peace Prize winner remembered as both foreign policy genius and war criminal

By Harriet Marsden, The Week UK Last updated

-

Trump’s rhetoric: a shift to 'straight-up Nazi talk'

Trump’s rhetoric: a shift to 'straight-up Nazi talk'Why everyone's talking about Would-be president's sinister language is backed by an incendiary policy agenda, say commentators

By The Week UK Published

-

More covfefe: is the world ready for a second Donald Trump presidency?

More covfefe: is the world ready for a second Donald Trump presidency?Today's Big Question Republican's re-election would be a 'nightmare' scenario for Europe, Ukraine and the West

By Sorcha Bradley, The Week UK Published