The daily business briefing: December 3, 2018

Stocks get a boost from U.S.-China trade war truce, Trump tweets that China will slash tariffs on U.S. cars, and more

1. U.S.-China trade truce boosts stocks

U.S. stock market futures surged early Monday after President Trump and Chinese President Xi Jinping agreed over the weekend to a temporary truce in their trade war. Futures for the Dow Jones Industrial Average rose by nearly 2 percent, while those of the S&P 500 and the Nasdaq-100 gained 1.7 percent and 2.4 percent, respectively. Trump and Xi met over the weekend at the Group of 20 summit in Argentina. Trump agreed to leave tariffs on more than $200 billion worth of Chinese products at 10 percent and only raise them to 25 percent, as previously planned, if the two countries fail to reach a long-term deal. Xi reportedly agreed to "substantial" purchases of U.S. agricultural, energy, and other products.

2. Trump says China will slash tariffs on U.S.-made cars

President Trump tweeted overnight that China had agreed to cut import tariffs on American-made cars. Beijing raised tariffs on U.S. auto imports to 40 percent in July in response to new tariffs imposed by Trump. That move came after China reduced auto import tariffs on other countries from 25 percent to 15 percent, so it put U.S. automakers like Tesla and Ford at a huge disadvantage in the world's biggest car market. The reduction announced by Trump, if executed, would bolster a 90-day cease-fire in the U.S.-China trade war that Trump and Chinese President Xi Jinping agreed to in a meeting during the G-20 summit in Argentina.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

3. Trump to end NAFTA, urging Congress to ratify new trade deal

President Trump said he will formally end the old North American Free Trade Agreement soon. That would force Congress to either ratify the new trade deal he signed Friday with leaders from Mexico and Canada, or leave the three nations with no deal in place. NAFTA has "been a disaster," Trump said on Air Force One on his way back from the Group of 20 summit in Argentina. Trump can formally withdraw from NAFTA six months after notifying Mexico and Canada, but he will need support from Democrats to ratify the new treaty. Rep. Nancy Pelosi (D-Calif.), the Democrats' nominee to be House speaker, said the new treaty was a "work in progress," and Sen. Sherrod Brown (D-Ohio) said it needed stronger labor standards.

4. Qatar announces plans to quit OPEC in January

Qatar announced Monday that it will withdraw from OPEC, the oil cartel it joined in 1961, in January to focus on developing its massive liquified natural gas (LNG) reserves. OPEC's de facto leader, Saudi Arabia, cut ties with Qatar and led an ongoing economic boycott in June 2017, joined by Egypt, the United Arab Emirates, and Bahrain. But Qatari energy affairs minister Saad Sherida al-Kaabi said politics weren't behind the decision to quit OPEC, and he will attend the 15-member organization's meeting later this week. Qatar produces only 600,000 barrels a day (bpd) of oil, versus Saudi Arabia's 11 million bpd, so its departure and aspirations to increase crude output are expected to have little effect on sagging global oil prices as OPEC tightens production.

5. Bank of America completes move of European hub from London to Dublin

Bank of America said Monday that it had finished moving its European banking and markets operations from London to Dublin as part of its preparation for Britain's exit from the European Union in March. The announcement came after the bank received required regulatory and court approvals. Bank of America announced last year that it planned to merge Bank of America Merrill Lynch International, its London-based subsidiary, into its Irish entity based in Dublin. International banks are worried that Brexit could mean their London operations will lose the right to operate across Europe.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Harold Maass is a contributing editor at The Week. He has been writing for The Week since the 2001 debut of the U.S. print edition and served as editor of TheWeek.com when it launched in 2008. Harold started his career as a newspaper reporter in South Florida and Haiti. He has previously worked for a variety of news outlets, including The Miami Herald, ABC News and Fox News, and for several years wrote a daily roundup of financial news for The Week and Yahoo Finance.

-

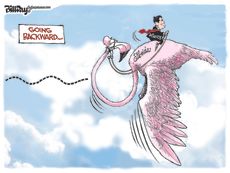

Today's political cartoons - April 15, 2024

Today's political cartoons - April 15, 2024Cartoons Monday's cartoons - flamingos in flight, taxes, and more

By The Week US Published

-

Empty-nest boomers aren't selling their big homes

Empty-nest boomers aren't selling their big homesSpeed Read Most Americans 60 and older do not intend to move, according to a recent survey

By Peter Weber, The Week US Published

-

Trump's first criminal trial starts with jury picks

Trump's first criminal trial starts with jury picksSpeed Read The former president faces charges related to hush money payments made to adult film star Stormy Daniels

By Peter Weber, The Week US Published

-

The daily business briefing: January 24, 2024

The daily business briefing: January 24, 2024Business Briefing The S&P 500 sets a third straight record, Netflix adds more subscribers than expected, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 23, 2024

The daily business briefing: January 23, 2024Business Briefing The Dow and S&P 500 set fresh records, Bitcoin falls as ETF enthusiasm fades, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 22, 2024

The daily business briefing: January 22, 2024Business Briefing FAA recommends inspections of a second Boeing 737 model, Macy's rejects Arkhouse bid, and more

By Harold Maass, The Week US Published

-

Geopolitics and the economy in 2024

Geopolitics and the economy in 2024Talking Point The West is banking on a year of falling inflation. Don't rule out a shock

By The Week UK Published

-

The daily business briefing: January 19, 2024

The daily business briefing: January 19, 2024Business Briefing Macy's to cut 2,350 jobs, Congress averts a government shutdown, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 18, 2024

The daily business briefing: January 18, 2024Business Briefing Shell suspends shipments in the Red Sea, December retail sales beat expectations, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 17, 2024

The daily business briefing: January 17, 2024Business Briefing Judge blocks JetBlue-Spirit merger plan, Goldman Sachs beats expectations with wealth-management boost, and more

By Harold Maass, The Week US Published

-

The daily business briefing: January 16, 2024

The daily business briefing: January 16, 2024Business Briefing Boeing steps up inspections on 737 Max 9 jets, Zelenskyy fights for world leaders' attention at Davos, and more

By Harold Maass, The Week US Published