1 in 4 households will pay more in taxes under Republican plan, nonpartisan report finds

Approximately 30 percent of taxpayers earning between $50,000 and $150,000 a year will see their taxes increase under the Republican tax proposal, the nonpartisan Urban-Brookings Tax Policy Center reported Friday. And while most Americans making between $150,000 and $300,000 will also see tax increases, the top one percent — earning more than $900,000 a year — will see taxes drop by an average of $200,000, The Washington Post reports.

President Trump has championed the Republican plan as being a major relief for the middle class, although 1 in 4 households would see their taxes go up. Additionally, The New York Times reports that Trump (or his heirs) would personally gain $1.1 billion if the proposal was implemented due in large part to the repeal of the estate tax.

The Tax Policy Center also concluded that the Republican plan would increase the deficit by $2.4 trillion over the next 10 years. "Republicans believe they will offset that lost revenue with increased economic growth prompted by the tax plan," The Washington Post writes. But analysts fret that if "economic growth projected by Republicans fails to materialize," then the massive cuts could "balloon the federal deficit and debt," Reuters reports. A handful of Republicans have already spoken out against the proposal: "The way we handle our finances, we as a nation are the greatest threat to our nation," Sen. Bob Corker (R-Tenn.) said.

Subscribe to The Week

Escape your echo chamber. Get the facts behind the news, plus analysis from multiple perspectives.

Sign up for The Week's Free Newsletters

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

From our morning news briefing to a weekly Good News Newsletter, get the best of The Week delivered directly to your inbox.

Create an account with the same email registered to your subscription to unlock access.

Sign up for Today's Best Articles in your inbox

A free daily email with the biggest news stories of the day – and the best features from TheWeek.com

Jeva Lange was the executive editor at TheWeek.com. She formerly served as The Week's deputy editor and culture critic. She is also a contributor to Screen Slate, and her writing has appeared in The New York Daily News, The Awl, Vice, and Gothamist, among other publications. Jeva lives in New York City. Follow her on Twitter.

-

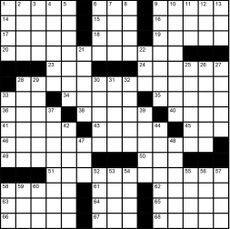

Magazine interactive crossword - April 26, 2024

Magazine interactive crossword - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine solutions - April 26, 2024

Magazine solutions - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Magazine printables - April 26, 2024

Magazine printables - April 26, 2024Puzzles and Quizzes Issue - April 26, 2024

By The Week US Published

-

Post Office's Capture software to be reviewed over 'glitches'

Post Office's Capture software to be reviewed over 'glitches'Speed Read Solicitor representing accused postmasters says flaws in the IT system follow 'very similar pattern' to Horizon

By Arion McNicoll, The Week UK Published

-

Empty-nest boomers aren't selling their big homes

Empty-nest boomers aren't selling their big homesSpeed Read Most Americans 60 and older do not intend to move, according to a recent survey

By Peter Weber, The Week US Published

-

Brazil accuses Musk of 'disinformation campaign'

Brazil accuses Musk of 'disinformation campaign'Speed Read A Brazilian Supreme Court judge has opened an inquiry into Elon Musk and X

By Rafi Schwartz, The Week US Published

-

Disney board fends off Peltz infiltration bid

Disney board fends off Peltz infiltration bidSpeed Read Disney CEO Bob Iger has defeated activist investor Nelson Peltz in a contentious proxy battle

By Rafi Schwartz, The Week US Published

-

Disney and DeSantis reach detente

Disney and DeSantis reach detenteSpeed Read The Florida governor and Disney settle a yearslong litigation over control of the tourism district

By Peter Weber, The Week US Published

-

Visa and Mastercard agree to lower swipe fees

Visa and Mastercard agree to lower swipe feesSpeed Read The companies will cap the fees they charge businesses when customers use their credit cards

By Peter Weber, The Week US Published

-

Reddit IPO values social media site at $6.4 billion

Reddit IPO values social media site at $6.4 billionSpeed Read The company makes its public debut on the New York Stock Exchange

By Peter Weber, The Week US Published

-

Housing costs: the root of US economic malaise?

Housing costs: the root of US economic malaise?speed read Many voters are troubled by the housing affordability crisis

By Peter Weber, The Week US Published